NSW

In December 2024, the NSW Self Insurance team underwent an audit by The State Insurance Regulatory Authority (SIRA) to evaluate the performance of our claims management methodology and compliance with NSW legislation.

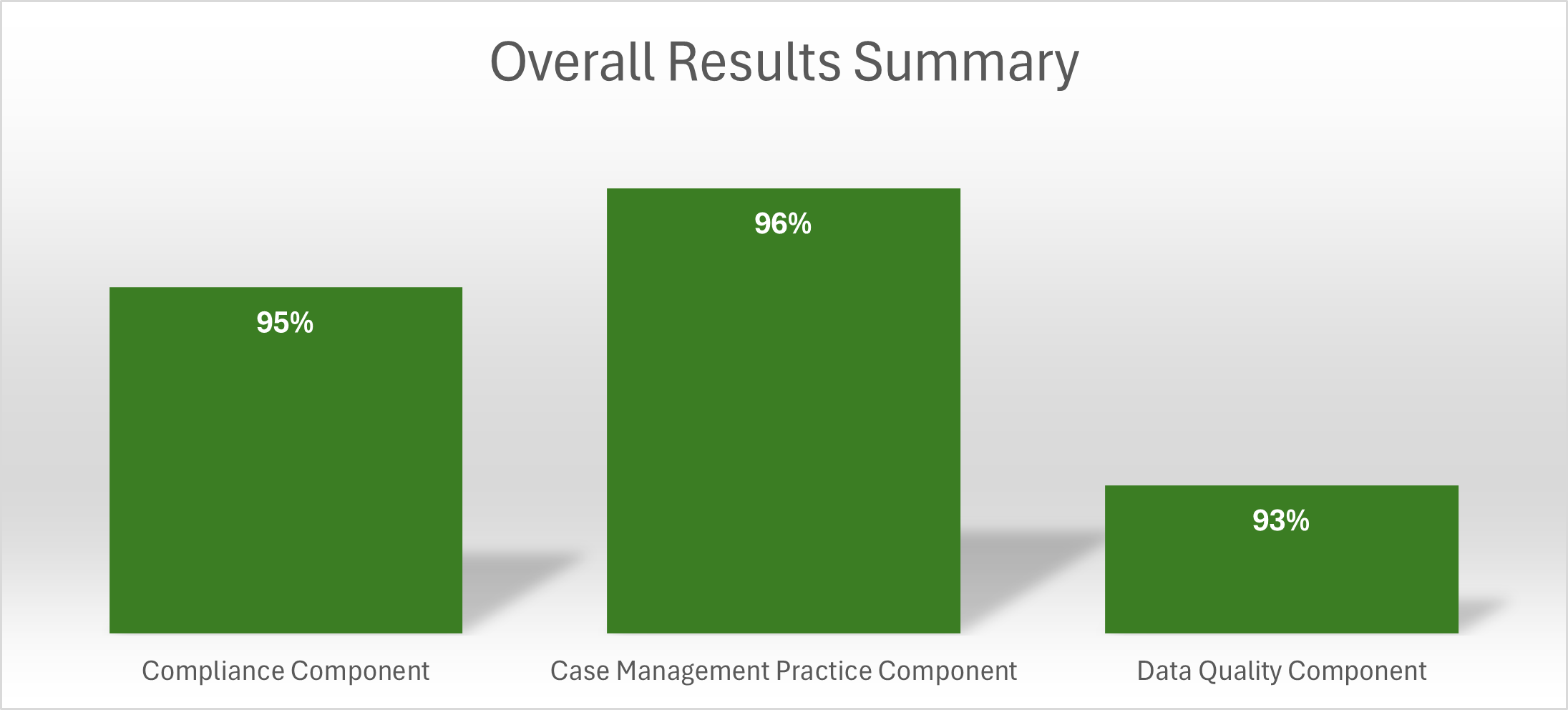

This audit was assessed across three components:

- Compliance: This measures Programmed’s adherence to the obligations and timeframes set by the workers’ compensation legislation and the Workers Compensation Guidelines.

- Case Management Practice: This evaluates Programmed’s practices in line with their Injury Management Program and SIRA’s expectations of case management, in accordance with the overarching case management principles and the Standards of Practice.

- Data Quality: This assesses the accuracy of data entered by Programmed against information held in the claim file, in line with SIRA data reporting requirements.

What these results mean:

- Continued confidence from the Regulator regarding our competency as a Self-Insurer

- Reinforced trust from our clients and stakeholders

- Recognition of our quality and governance standards

We should all take pride in this achievement as it reflects our shared values of Personal Safety Leadership, Care and Empathy, Customer Service and Diversity, inclusion and equality.

The result of the audit demonstrates the outstanding achievement by the NSW Self Insurance team to be able to maintain a top tier self-insurance licence by averaging an overall compliance rating of 94.66%.

South Australia

As part of our self-insurance license requirements in South Australia, we must undergo an evaluation process before the end of our license term (30 June 2025) to determine whether we are deemed suitable to continue holding a Self-Insurance license in South Australia.

The renewal of the self-insurance license is a lengthy and structured process that requires considerable investment from Programmed’s HSE and Injury Management teams.

In January and February 2025, the IM and HSE teams underwent a 6-week evaluation using 36 claims and a detailed analysis of our policies and procedures. This process took the teams out of action for two weeks to accommodate the Evaluators at our Underdale office.

The evaluation is based on our compliance with Injury Management and Work Health and Safety Standards set by ReturnToWork SA and other relevant legislation.

We have now received our draft Evaluation Report, which included 7 observations, no non-conformances, and no terms or conditions for the renewal. This is an outstanding achievement by the teams.

We are proud to report that, with the support of the HSE team in South Australia, Programmed has been granted a 5-year renewal from July 2025, which is the maximum limit granted in South Australia. This is a fantastic effort by both the HSE and IM teams in SA.

Annual Workers Compensation Payment

A key measure for the workers compensation team is the total amount of compensation payable when employees are receiving weekly benefits. The team's goal this financial year is to improve the total amount of weekly compensation by implementing sustainable return-to-work options.

The tables below summarize the annual spend across the country by business unit and state over the last financial period.

Initiatives to Achieve Our Goals:

- Engaging with business units to ensure the branches are providing suitable duties that are meaningful.

- Reducing our reliance on online learning.

- Working with the National Account Managers to help identify clients who will provide suitable duties for our injured workers.

- Providing continued education to the business, focusing on positive support and engagement with our injured employees.

- Increasing face-to-face meetings at medical appointments and branches to engage better with all stakeholders.